SBI Equity Hybrid Fund - Regular Plan -Growth

(Erstwhile SBI Magnum Balanced Fund - REGULAR PLAN -Growth)

| Category: Hybrid: Aggressive |

| Launch Date: 01-12-1995 |

| Asset Class: Mixed Asset |

| Benchmark: CRISIL Hybrid 35+65 Aggressive Index |

| Expense Ratio: 1.38% As on (28-11-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 1000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 82,861.53 Cr As on (28-11-2025) |

| Turn over: 18% |

309.3957

1.91 (0.6162%)

13.99%

CRISIL Hybrid 35+65 Aggressive Index 12.34%

PERFORMANCE of SBI Equity Hybrid Fund - Regular Plan -Growth

Scheme Performance (%)

Data as on - 12-12-2025Yearly Performance (%)

Fund Managers

Mr. R Srinivasan, Mr. Rajeev Radhakrishnan, Ms. Mansi Sajeja, Mr. Pradeep Kesavan,

Investment Objective

To provide investors long term capital appreciation along with the liquidity of an open-ended scheme by investing in a mix of debt and equity. The scheme will invest in a diversified portfolio of equities of high growth companies and balance the risk through investing the rest in fixed income securities.

NAV & Lumpsum details( Invested amount 1,00,000)

| NAV Date | NAV | Units | Market Value |

Returns (%) |

|---|---|---|---|---|

| 31-12-1995 | 10.0733 | 9927.2334 | 100000 | 0.0 % |

| 01-02-1996 | 10.16 | - | 100861 | 0.86 % |

| 29-02-1996 | 10.27 | - | 101953 | 1.95 % |

| 29-03-1996 | 10.39 | - | 103144 | 3.14 % |

| 30-04-1996 | 10.83 | - | 107512 | 7.51 % |

| 30-05-1996 | 10.78 | - | 107016 | 7.02 % |

| 01-07-1996 | 10.92 | - | 108405 | 8.4 % |

| 30-07-1996 | 10.45 | - | 103740 | 3.74 % |

| 29-08-1996 | 10.46 | - | 103839 | 3.84 % |

| 30-09-1996 | 10.17 | - | 100960 | 0.96 % |

| 30-10-1996 | 10.1511 | - | 100772 | 0.77 % |

| 29-11-1996 | 9.907 | - | 98349 | -1.65 % |

| 01-01-1997 | 10.47 | - | 103938 | 3.94 % |

| 29-01-1997 | 10.9005 | - | 108212 | 8.21 % |

| 28-02-1997 | 11.11 | - | 110292 | 10.29 % |

| 28-03-1997 | 11.34 | - | 112575 | 12.57 % |

| 28-04-1997 | 11.54 | - | 114560 | 14.56 % |

| 28-05-1997 | 11.56 | - | 114759 | 14.76 % |

| 30-06-1997 | 12.27 | - | 121807 | 21.81 % |

| 28-07-1997 | 12.64 | - | 125480 | 25.48 % |

| 28-08-1997 | 12.34 | - | 122502 | 22.5 % |

| 29-09-1997 | 12.07 | - | 119822 | 19.82 % |

| 28-10-1997 | 11.68 | - | 115950 | 15.95 % |

| 28-11-1997 | 10.16 | - | 100861 | 0.86 % |

| 29-12-1997 | 10.28 | - | 102052 | 2.05 % |

| 28-01-1998 | 9.45 | - | 93812 | -6.19 % |

| 02-03-1998 | 10.27 | - | 101953 | 1.95 % |

| 30-03-1998 | 10.61 | - | 105328 | 5.33 % |

| 28-04-1998 | 11.11 | - | 110292 | 10.29 % |

| 28-05-1998 | 10.88 | - | 108008 | 8.01 % |

| 29-06-1998 | 10.01 | - | 99372 | -0.63 % |

| 28-07-1998 | 10.23 | - | 101556 | 1.56 % |

| 28-08-1998 | 10.06 | - | 99868 | -0.13 % |

| 28-09-1998 | 10.69 | - | 106122 | 6.12 % |

| 28-10-1998 | 10.16 | - | 100861 | 0.86 % |

| 28-11-1998 | 10.0338 | - | 99608 | -0.39 % |

| 28-12-1998 | 10.66 | - | 105824 | 5.82 % |

| 28-01-1999 | 11.79 | - | 117042 | 17.04 % |

| 01-03-1999 | 13.25 | - | 131536 | 31.54 % |

| 30-03-1999 | 14.28 | - | 141761 | 41.76 % |

| 28-04-1999 | 12.4 | - | 123098 | 23.1 % |

| 28-05-1999 | 12.92 | - | 128260 | 28.26 % |

| 28-06-1999 | 13.51 | - | 134117 | 34.12 % |

| 28-07-1999 | 15.04 | - | 149306 | 49.31 % |

| 30-08-1999 | 17.5 | - | 173727 | 73.73 % |

| 28-09-1999 | 18.13 | - | 179981 | 79.98 % |

| 28-10-1999 | 18.57 | - | 184349 | 84.35 % |

| 29-11-1999 | 21.2 | - | 210457 | 110.46 % |

| 28-12-1999 | 28.73 | - | 285209 | 185.21 % |

| 28-01-2000 | 38.22 | - | 379419 | 279.42 % |

| 28-02-2000 | 43.32 | - | 430048 | 330.05 % |

| 28-03-2000 | 25.52 | - | 253343 | 153.34 % |

| 28-04-2000 | 15.59 | - | 154766 | 54.77 % |

| 29-05-2000 | 14.0 | - | 138981 | 38.98 % |

| 28-06-2000 | 16.75 | - | 166281 | 66.28 % |

| 31-07-2000 | 14.77 | - | 146625 | 46.62 % |

| 28-08-2000 | 15.25 | - | 151390 | 51.39 % |

| 28-09-2000 | 14.38 | - | 142754 | 42.75 % |

| 30-10-2000 | 13.09 | - | 129947 | 29.95 % |

| 28-11-2000 | 13.42 | - | 133223 | 33.22 % |

| 29-12-2000 | 12.93 | - | 128359 | 28.36 % |

| 29-01-2001 | 13.28 | - | 131834 | 31.83 % |

| 28-02-2001 | 12.29 | - | 122006 | 22.01 % |

| 28-03-2001 | 10.25 | - | 101754 | 1.75 % |

| 30-04-2001 | 9.41 | - | 93415 | -6.59 % |

| 28-05-2001 | 10.49 | - | 104137 | 4.14 % |

| 28-06-2001 | 9.78 | - | 97088 | -2.91 % |

| 30-07-2001 | 9.37 | - | 93018 | -6.98 % |

| 28-08-2001 | 9.44 | - | 93713 | -6.29 % |

| 28-09-2001 | 8.74 | - | 86764 | -13.24 % |

| 29-10-2001 | 9.06 | - | 89941 | -10.06 % |

| 28-11-2001 | 9.66 | - | 95897 | -4.1 % |

| 28-12-2001 | 9.41 | - | 93415 | -6.59 % |

| 28-01-2002 | 9.6 | - | 95301 | -4.7 % |

| 28-02-2002 | 9.96 | - | 98875 | -1.12 % |

| 28-03-2002 | 9.87 | - | 97982 | -2.02 % |

| 29-04-2002 | 10.0 | - | 99272 | -0.73 % |

| 28-05-2002 | 9.48 | - | 94110 | -5.89 % |

| 28-06-2002 | 9.49 | - | 94209 | -5.79 % |

| 29-07-2002 | 8.92 | - | 88551 | -11.45 % |

| 28-08-2002 | 9.07 | - | 90040 | -9.96 % |

| 30-09-2002 | 8.83 | - | 87657 | -12.34 % |

| 28-10-2002 | 8.66 | - | 85970 | -14.03 % |

| 28-11-2002 | 9.16 | - | 90933 | -9.07 % |

| 30-12-2002 | 9.42 | - | 93515 | -6.49 % |

| 28-01-2003 | 9.24 | - | 91728 | -8.27 % |

| 28-02-2003 | 9.33 | - | 92621 | -7.38 % |

| 28-03-2003 | 9.14 | - | 90735 | -9.26 % |

| 28-04-2003 | 9.09 | - | 90239 | -9.76 % |

| 28-05-2003 | 9.46 | - | 93912 | -6.09 % |

| 30-06-2003 | 10.48 | - | 104037 | 4.04 % |

| 28-07-2003 | 11.39 | - | 113071 | 13.07 % |

| 28-08-2003 | 12.5 | - | 124090 | 24.09 % |

| 29-09-2003 | 12.92 | - | 128260 | 28.26 % |

| 28-10-2003 | 12.63 | - | 125381 | 25.38 % |

| 28-11-2003 | 13.55 | - | 134514 | 34.51 % |

| 29-12-2003 | 15.39 | - | 152780 | 52.78 % |

| 28-01-2004 | 15.16 | - | 150497 | 50.5 % |

| 01-03-2004 | 13.44 | - | 133422 | 33.42 % |

| 29-03-2004 | 13.15 | - | 130543 | 30.54 % |

| 28-04-2004 | 14.23 | - | 141265 | 41.27 % |

| 28-05-2004 | 12.69 | - | 125977 | 25.98 % |

| 28-06-2004 | 12.75 | - | 126572 | 26.57 % |

| 28-07-2004 | 13.28 | - | 131834 | 31.83 % |

| 30-08-2004 | 13.89 | - | 137889 | 37.89 % |

| 28-09-2004 | 14.31 | - | 142059 | 42.06 % |

| 28-10-2004 | 15.07 | - | 149603 | 49.6 % |

| 29-11-2004 | 16.61 | - | 164891 | 64.89 % |

| 28-12-2004 | 17.91 | - | 177797 | 77.8 % |

| 28-01-2005 | 17.64 | - | 175116 | 75.12 % |

| 28-02-2005 | 18.47 | - | 183356 | 83.36 % |

| 28-03-2005 | 18.47 | - | 183356 | 83.36 % |

| 28-04-2005 | 18.61 | - | 184746 | 84.75 % |

| 30-05-2005 | 19.6 | - | 194574 | 94.57 % |

| 28-06-2005 | 19.94 | - | 197949 | 97.95 % |

| 29-07-2005 | 22.1 | - | 219392 | 119.39 % |

| 29-08-2005 | 23.22 | - | 230510 | 130.51 % |

| 28-09-2005 | 24.68 | - | 245004 | 145.0 % |

| 28-10-2005 | 23.35 | - | 231801 | 131.8 % |

| 28-11-2005 | 25.87 | - | 256818 | 156.82 % |

| 28-12-2005 | 26.13 | - | 259399 | 159.4 % |

| 30-01-2006 | 27.78 | - | 275779 | 175.78 % |

| 28-02-2006 | 28.55 | - | 283423 | 183.42 % |

| 28-03-2006 | 30.98 | - | 307546 | 207.55 % |

| 28-04-2006 | 33.27 | - | 330279 | 230.28 % |

| 29-05-2006 | 30.76 | - | 305362 | 205.36 % |

| 28-06-2006 | 27.95 | - | 277466 | 177.47 % |

| 28-07-2006 | 28.58 | - | 283720 | 183.72 % |

| 28-08-2006 | 30.87 | - | 306454 | 206.45 % |

| 28-09-2006 | 31.69 | - | 314594 | 214.59 % |

| 30-10-2006 | 33.32 | - | 330775 | 230.78 % |

| 28-11-2006 | 35.18 | - | 349240 | 249.24 % |

| 28-12-2006 | 35.31 | - | 350531 | 250.53 % |

| 29-01-2007 | 36.26 | - | 359961 | 259.96 % |

| 28-02-2007 | 33.88 | - | 336335 | 236.34 % |

| 28-03-2007 | 33.61 | - | 333654 | 233.65 % |

| 30-04-2007 | 35.82 | - | 355594 | 255.59 % |

| 28-05-2007 | 37.27 | - | 369988 | 269.99 % |

| 28-06-2007 | 37.86 | - | 375845 | 275.84 % |

| 30-07-2007 | 38.83 | - | 385474 | 285.47 % |

| 28-08-2007 | 38.5 | - | 382198 | 282.2 % |

| 28-09-2007 | 43.14 | - | 428261 | 328.26 % |

| 29-10-2007 | 48.05 | - | 477004 | 377.0 % |

| 28-11-2007 | 47.78 | - | 474323 | 374.32 % |

| 28-12-2007 | 51.95 | - | 515720 | 415.72 % |

| 28-01-2008 | 45.91 | - | 455759 | 355.76 % |

| 28-02-2008 | 45.41 | - | 450796 | 350.8 % |

| 28-03-2008 | 41.34 | - | 410392 | 310.39 % |

| 28-04-2008 | 42.29 | - | 419823 | 319.82 % |

| 28-05-2008 | 40.72 | - | 404237 | 304.24 % |

| 30-06-2008 | 35.52 | - | 352615 | 252.61 % |

| 28-07-2008 | 37.12 | - | 368499 | 268.5 % |

| 28-08-2008 | 36.79 | - | 365223 | 265.22 % |

| 29-09-2008 | 33.97 | - | 337228 | 237.23 % |

| 29-10-2008 | 27.04 | - | 268432 | 168.43 % |

| 28-11-2008 | 27.03 | - | 268333 | 168.33 % |

| 29-12-2008 | 28.65 | - | 284415 | 184.41 % |

| 28-01-2009 | 27.74 | - | 275381 | 175.38 % |

| 02-03-2009 | 26.49 | - | 262972 | 162.97 % |

| 30-03-2009 | 28.36 | - | 281536 | 181.54 % |

| 28-04-2009 | 31.77 | - | 315388 | 215.39 % |

| 28-05-2009 | 39.92 | - | 396295 | 296.3 % |

| 29-06-2009 | 41.15 | - | 408506 | 308.51 % |

| 28-07-2009 | 42.2 | - | 418929 | 318.93 % |

| 28-08-2009 | 43.5 | - | 431835 | 331.84 % |

| 29-09-2009 | 45.44 | - | 451093 | 351.09 % |

| 28-10-2009 | 44.54 | - | 442159 | 342.16 % |

| 30-11-2009 | 46.11 | - | 457745 | 357.75 % |

| 29-12-2009 | 47.5 | - | 471544 | 371.54 % |

| 28-01-2010 | 46.35 | - | 460127 | 360.13 % |

| 02-03-2010 | 46.63 | - | 462907 | 362.91 % |

| 29-03-2010 | 48.42 | - | 480677 | 380.68 % |

| 28-04-2010 | 48.95 | - | 485938 | 385.94 % |

| 28-05-2010 | 47.29 | - | 469459 | 369.46 % |

| 28-06-2010 | 49.28 | - | 489214 | 389.21 % |

| 28-07-2010 | 50.32 | - | 499538 | 399.54 % |

| 30-08-2010 | 50.85 | - | 504800 | 404.8 % |

| 28-09-2010 | 53.97 | - | 535773 | 435.77 % |

| 28-10-2010 | 53.98 | - | 535872 | 435.87 % |

| 29-11-2010 | 52.45 | - | 520683 | 420.68 % |

| 28-12-2010 | 52.86 | - | 524754 | 424.75 % |

| 28-01-2011 | 49.67 | - | 493086 | 393.09 % |

| 28-02-2011 | 48.11 | - | 477599 | 377.6 % |

| 28-03-2011 | 49.65 | - | 492887 | 392.89 % |

| 28-04-2011 | 50.92 | - | 505495 | 405.5 % |

| 30-05-2011 | 48.9 | - | 485442 | 385.44 % |

| 28-06-2011 | 49.4 | - | 490405 | 390.4 % |

| 28-07-2011 | 49.16 | - | 488023 | 388.02 % |

| 29-08-2011 | 44.9 | - | 445733 | 345.73 % |

| 28-09-2011 | 45.06 | - | 447321 | 347.32 % |

| 28-10-2011 | 46.6 | - | 462609 | 362.61 % |

| 28-11-2011 | 43.93 | - | 436103 | 336.1 % |

| 28-12-2011 | 42.14 | - | 418334 | 318.33 % |

| 30-01-2012 | 44.83 | - | 445038 | 345.04 % |

| 28-02-2012 | 46.92 | - | 465786 | 365.79 % |

| 28-03-2012 | 46.5 | - | 461616 | 361.62 % |

| 30-04-2012 | 47.77 | - | 474224 | 374.22 % |

| 28-05-2012 | 46.33 | - | 459929 | 359.93 % |

| 28-06-2012 | 47.13 | - | 467871 | 367.87 % |

| 30-07-2012 | 48.66 | - | 483059 | 383.06 % |

| 28-08-2012 | 49.33 | - | 489710 | 389.71 % |

| 28-09-2012 | 52.11 | - | 517308 | 417.31 % |

| 29-10-2012 | 53.17 | - | 527831 | 427.83 % |

| 29-11-2012 | 55.41 | - | 550068 | 450.07 % |

| 28-12-2012 | 56.18 | - | 557712 | 457.71 % |

| 28-01-2013 | 57.64 | - | 572206 | 472.21 % |

| 28-02-2013 | 55.6324 | - | 552276 | 452.28 % |

| 28-03-2013 | 54.531 | - | 541342 | 441.34 % |

| 29-04-2013 | 56.1227 | - | 557143 | 457.14 % |

| 28-05-2013 | 58.4699 | - | 580444 | 480.44 % |

| 28-06-2013 | 55.8124 | - | 554063 | 454.06 % |

| 29-07-2013 | 55.9297 | - | 555227 | 455.23 % |

| 28-08-2013 | 52.5469 | - | 521645 | 421.64 % |

| 30-09-2013 | 55.2837 | - | 548814 | 448.81 % |

| 28-10-2013 | 58.112 | - | 576891 | 476.89 % |

| 28-11-2013 | 60.2932 | - | 598545 | 498.55 % |

| 30-12-2013 | 62.9763 | - | 625180 | 525.18 % |

| 28-01-2014 | 61.8006 | - | 613509 | 513.51 % |

| 28-02-2014 | 62.3404 | - | 618868 | 518.87 % |

| 28-03-2014 | 65.5924 | - | 651151 | 551.15 % |

| 28-04-2014 | 68.0198 | - | 675248 | 575.25 % |

| 28-05-2014 | 72.1428 | - | 716178 | 616.18 % |

| 30-06-2014 | 76.6196 | - | 760621 | 660.62 % |

| 28-07-2014 | 78.5045 | - | 779332 | 679.33 % |

| 28-08-2014 | 81.5319 | - | 809386 | 709.39 % |

| 29-09-2014 | 83.2359 | - | 826302 | 726.3 % |

| 28-10-2014 | 84.4524 | - | 838379 | 738.38 % |

| 28-11-2014 | 88.9143 | - | 882673 | 782.67 % |

| 29-12-2014 | 89.4862 | - | 888350 | 788.35 % |

| 28-01-2015 | 96.1063 | - | 954070 | 854.07 % |

| 02-03-2015 | 96.2716 | - | 955711 | 855.71 % |

| 30-03-2015 | 94.762 | - | 940724 | 840.72 % |

| 28-04-2015 | 93.7257 | - | 930437 | 830.44 % |

| 28-05-2015 | 94.6116 | - | 939231 | 839.23 % |

| 29-06-2015 | 93.9648 | - | 932811 | 832.81 % |

| 28-07-2015 | 95.7218 | - | 950253 | 850.25 % |

| 28-08-2015 | 94.6401 | - | 939514 | 839.51 % |

| 28-09-2015 | 93.3754 | - | 926959 | 826.96 % |

| 28-10-2015 | 96.7306 | - | 960267 | 860.27 % |

| 30-11-2015 | 96.4228 | - | 957212 | 857.21 % |

| 28-12-2015 | 96.6653 | - | 959619 | 859.62 % |

| 28-01-2016 | 92.6923 | - | 920178 | 820.18 % |

| 29-02-2016 | 88.0906 | - | 874496 | 774.5 % |

| 28-03-2016 | 93.0347 | - | 923577 | 823.58 % |

| 28-04-2016 | 96.0978 | - | 953985 | 853.98 % |

| 30-05-2016 | 97.6677 | - | 969570 | 869.57 % |

| 28-06-2016 | 98.6099 | - | 978923 | 878.92 % |

| 28-07-2016 | 103.8645 | - | 1031087 | 931.09 % |

| 29-08-2016 | 103.9495 | - | 1031931 | 931.93 % |

| 28-09-2016 | 106.2076 | - | 1054348 | 954.35 % |

| 28-10-2016 | 107.9896 | - | 1072038 | 972.04 % |

| 28-11-2016 | 103.3015 | - | 1025498 | 925.5 % |

| 28-12-2016 | 99.5216 | - | 987974 | 887.97 % |

| 30-01-2017 | 104.8749 | - | 1041118 | 941.12 % |

| 28-02-2017 | 106.5308 | - | 1057556 | 957.56 % |

| 28-03-2017 | 107.4783 | - | 1066962 | 966.96 % |

| 28-04-2017 | 110.4476 | - | 1096439 | 996.44 % |

| 29-05-2017 | 110.6614 | - | 1098562 | 998.56 % |

| 28-06-2017 | 113.1397 | - | 1123164 | 1023.16 % |

| 28-07-2017 | 118.2614 | - | 1174009 | 1074.01 % |

| 28-08-2017 | 117.6494 | - | 1167933 | 1067.93 % |

| 28-09-2017 | 117.3024 | - | 1164488 | 1064.49 % |

| 30-10-2017 | 123.7697 | - | 1228691 | 1128.69 % |

| 28-11-2017 | 126.341 | - | 1254217 | 1154.22 % |

| 28-12-2017 | 127.9474 | - | 1270164 | 1170.16 % |

| 29-01-2018 | 130.0206 | - | 1290745 | 1190.75 % |

| 28-02-2018 | 125.0805 | - | 1241703 | 1141.7 % |

| 28-03-2018 | 122.7933 | - | 1218998 | 1119.0 % |

| 30-04-2018 | 128.06 | - | 1271282 | 1171.28 % |

| 28-05-2018 | 127.044 | - | 1261195 | 1161.19 % |

| 28-06-2018 | 123.9804 | - | 1230782 | 1130.78 % |

| 30-07-2018 | 129.2465 | - | 1283060 | 1183.06 % |

| 28-08-2018 | 131.4293 | - | 1304729 | 1204.73 % |

| 28-09-2018 | 124.3509 | - | 1234460 | 1134.46 % |

| 29-10-2018 | 120.8474 | - | 1199680 | 1099.68 % |

| 28-11-2018 | 125.0865 | - | 1241763 | 1141.76 % |

| 28-12-2018 | 127.913 | - | 1269822 | 1169.82 % |

| 28-01-2019 | 125.0858 | - | 1241756 | 1141.76 % |

| 28-02-2019 | 126.0351 | - | 1251180 | 1151.18 % |

| 28-03-2019 | 133.6836 | - | 1327108 | 1227.11 % |

| 30-04-2019 | 134.4602 | - | 1334818 | 1234.82 % |

| 28-05-2019 | 138.3172 | - | 1373107 | 1273.11 % |

| 28-06-2019 | 137.9018 | - | 1368983 | 1268.98 % |

| 29-07-2019 | 134.9587 | - | 1339767 | 1239.77 % |

| 28-08-2019 | 133.9108 | - | 1329364 | 1229.36 % |

| 30-09-2019 | 139.7992 | - | 1387819 | 1287.82 % |

| 29-10-2019 | 141.4507 | - | 1404214 | 1304.21 % |

| 28-11-2019 | 145.3849 | - | 1443270 | 1343.27 % |

| 30-12-2019 | 146.0084 | - | 1449459 | 1349.46 % |

| 28-01-2020 | 147.6461 | - | 1465717 | 1365.72 % |

| 28-02-2020 | 144.268 | - | 1432182 | 1332.18 % |

| 30-03-2020 | 115.9504 | - | 1151067 | 1051.07 % |

| 28-04-2020 | 124.6959 | - | 1237885 | 1137.88 % |

| 28-05-2020 | 124.2364 | - | 1233324 | 1133.32 % |

| 29-06-2020 | 132.7233 | - | 1317575 | 1217.58 % |

| 28-07-2020 | 138.8972 | - | 1378865 | 1278.87 % |

| 28-08-2020 | 144.8053 | - | 1437516 | 1337.52 % |

| 28-09-2020 | 138.941 | - | 1379300 | 1279.3 % |

| 28-10-2020 | 142.1659 | - | 1411314 | 1311.31 % |

| 01-12-2020 | 157.2192 | - | 1560752 | 1460.75 % |

| 28-12-2020 | 163.4822 | - | 1622926 | 1522.93 % |

| 28-01-2021 | 163.0618 | - | 1618753 | 1518.75 % |

| 01-03-2021 | 173.216 | - | 1719556 | 1619.56 % |

| 30-03-2021 | 173.0797 | - | 1718203 | 1618.2 % |

| 28-04-2021 | 174.3958 | - | 1731268 | 1631.27 % |

| 28-05-2021 | 180.6545 | - | 1793399 | 1693.4 % |

| 28-06-2021 | 185.4846 | - | 1841349 | 1741.35 % |

| 28-07-2021 | 187.8948 | - | 1865276 | 1765.28 % |

| 30-08-2021 | 196.0906 | - | 1946637 | 1846.64 % |

| 28-09-2021 | 203.4143 | - | 2019341 | 1919.34 % |

| 28-10-2021 | 204.7109 | - | 2032213 | 1932.21 % |

| 29-11-2021 | 200.1492 | - | 1986928 | 1886.93 % |

| 28-12-2021 | 201.6921 | - | 2002245 | 1902.24 % |

| 28-01-2022 | 199.4664 | - | 1980150 | 1880.15 % |

| 28-02-2022 | 198.3573 | - | 1969139 | 1869.14 % |

| 28-03-2022 | 201.87 | - | 2004011 | 1904.01 % |

| 28-04-2022 | 202.7097 | - | 2012347 | 1912.35 % |

| 30-05-2022 | 195.8185 | - | 1943936 | 1843.94 % |

| 28-06-2022 | 188.0998 | - | 1867311 | 1767.31 % |

| 28-07-2022 | 199.1759 | - | 1977266 | 1877.27 % |

| 29-08-2022 | 202.8147 | - | 2013389 | 1913.39 % |

| 28-09-2022 | 201.4193 | - | 1999536 | 1899.54 % |

| 28-10-2022 | 206.3656 | - | 2048639 | 1948.64 % |

| 28-11-2022 | 209.4168 | - | 2078929 | 1978.93 % |

| 28-12-2022 | 207.6701 | - | 2061590 | 1961.59 % |

| 30-01-2023 | 201.2604 | - | 1997959 | 1897.96 % |

| 28-02-2023 | 197.6965 | - | 1962579 | 1862.58 % |

| 28-03-2023 | 195.1778 | - | 1937576 | 1837.58 % |

| 28-04-2023 | 205.6312 | - | 2041349 | 1941.35 % |

| 29-05-2023 | 210.9602 | - | 2094251 | 1994.25 % |

| 28-06-2023 | 215.7985 | - | 2142282 | 2042.28 % |

| 28-07-2023 | 222.346 | - | 2207281 | 2107.28 % |

| 28-08-2023 | 222.0514 | - | 2204356 | 2104.36 % |

| 29-09-2023 | 225.2647 | - | 2236255 | 2136.26 % |

| 30-10-2023 | 222.0835 | - | 2204675 | 2104.67 % |

| 28-11-2023 | 229.0439 | - | 2273772 | 2173.77 % |

| 28-12-2023 | 242.0432 | - | 2402819 | 2302.82 % |

| 29-01-2024 | 243.7304 | - | 2419569 | 2319.57 % |

| 28-02-2024 | 244.7021 | - | 2429215 | 2329.22 % |

| 28-03-2024 | 252.2876 | - | 2504518 | 2404.52 % |

| 29-04-2024 | 258.1781 | - | 2562994 | 2462.99 % |

| 28-05-2024 | 262.3272 | - | 2604183 | 2504.18 % |

| 28-06-2024 | 272.7699 | - | 2707850 | 2607.85 % |

| 29-07-2024 | 278.8807 | - | 2768514 | 2668.51 % |

| 28-08-2024 | 280.6827 | - | 2786403 | 2686.4 % |

| 30-09-2024 | 288.3938 | - | 2862953 | 2762.95 % |

| 28-10-2024 | 274.998 | - | 2729969 | 2629.97 % |

| 28-11-2024 | 276.291 | - | 2742805 | 2642.8 % |

| 30-12-2024 | 276.1262 | - | 2741169 | 2641.17 % |

| 28-01-2025 | 269.6675 | - | 2677052 | 2577.05 % |

| 28-02-2025 | 264.786 | - | 2628592 | 2528.59 % |

| 28-03-2025 | 280.8837 | - | 2788398 | 2688.4 % |

| 28-04-2025 | 289.0503 | - | 2869470 | 2769.47 % |

| 28-05-2025 | 296.1992 | - | 2940439 | 2840.44 % |

| 30-06-2025 | 307.0524 | - | 3048181 | 2948.18 % |

| 28-07-2025 | 299.0914 | - | 2969150 | 2869.15 % |

| 28-08-2025 | 295.8596 | - | 2937067 | 2837.07 % |

| 29-09-2025 | 299.8548 | - | 2976729 | 2876.73 % |

| 28-10-2025 | 311.0928 | - | 3088291 | 2988.29 % |

| 28-11-2025 | 311.8104 | - | 3095415 | 2995.41 % |

| 12-12-2025 | 309.3957 | - | 3071443 | 2971.44 % |

RETURNS CALCULATOR for SBI Equity Hybrid Fund - Regular Plan -Growth

Growth of 10000 In SIP (Fund vs Benchmark)

Growth of 10000 In LUMPSUM (Fund vs Benchmark)

Rolling Returns

Rolling returns are the annualized returns of the scheme taken for a specified period (rolling returns period) on every day/week/month and taken till the last day of the duration. In this chart we are showing the annualized returns over the rolling returns period on every day from the start date and comparing it with the benchmark. Rolling returns is the best measure of a fund's performance. Trailing returns have a recency bias and point to point returns are specific to the period in consideration. Rolling returns, on the other hand, measures the fund's absolute and relative performance across all timescales, without bias.

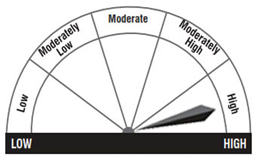

Riskometer

Key Performance and Risk Statistics of SBI Equity Hybrid Fund - Regular Plan -Growth

| Key Statistics | Volatility | Sharpe Ratio | Alpha | Beta | Yield to Maturity | Average Maturity |

|---|---|---|---|---|---|---|

| SBI Equity Hybrid Fund - Regular Plan -Growth | 8.66 | 0.89 | 1.84 | 1.06 | 7.55 | 7.87 |

| Hybrid: Aggressive | - | - | - | - | - | - |

PEER COMPARISION of SBI Equity Hybrid Fund - Regular Plan -Growth

PORTFOLIO ANALYSIS of SBI Equity Hybrid Fund - Regular Plan -Growth

Asset Allocation (%)

| Allocation | Percentage (%) |

|---|

Market Cap Distribution

Small Cap

2.17%

Others

25.98%

Large Cap

58.7%

Mid Cap

13.24%

Total

100%