JM Aggressive Hybrid Fund (Regular) -Growth Option

(Erstwhile JM Balanced Fund-Growth)

| Category: Hybrid: Aggressive |

| Launch Date: 01-04-1995 |

| Asset Class: Mixed Asset |

| Benchmark: CRISIL Hybrid 35+65 Aggressive Index |

| Expense Ratio: 2.29% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 1000.0 |

| Minimum Topup: 100.0 |

| Total Assets: 780.96 Cr As on (31-12-2025) |

| Turn over: 115.33% |

118.9691

0.33 (0.2791%)

12.01%

CRISIL Hybrid 35+65 Aggressive Index 12.27%

PERFORMANCE of JM Aggressive Hybrid Fund (Regular) -Growth Option

Scheme Performance (%)

Data as on - 16-01-2026Yearly Performance (%)

Fund Managers

Mr. Asit Bhandarkar, Mr. Satish Ramanathan,Mr. Deepak Gupta , Ms. Ruchi Fozdar

Investment Objective

The investment objective is to provide steady current income as well as long term growth of capital.There can be no assurance that the investment objective of the scheme will be realized. The scheme does not guarantee/ indicate any returns. Investors are required to read all the scheme related information set out in this document carefully.

NAV & Lumpsum details( Invested amount 1,00,000)

| NAV Date | NAV | Units | Market Value |

Returns (%) |

|---|---|---|---|---|

| 01-04-1995 | 10.0 | 10000.0 | 100000 | 0.0 % |

| 02-05-1995 | 9.31 | - | 93100 | -6.9 % |

| 07-06-1995 | 9.7 | - | 97000 | -3.0 % |

| 07-07-1995 | 9.7 | - | 97000 | -3.0 % |

| 07-08-1995 | 9.94 | - | 99400 | -0.6 % |

| 07-09-1995 | 9.87 | - | 98700 | -1.3 % |

| 04-10-1995 | 10.01 | - | 100100 | 0.1 % |

| 08-11-1995 | 9.76 | - | 97600 | -2.4 % |

| 07-12-1995 | 9.61 | - | 96100 | -3.9 % |

| 01-01-1996 | 9.68 | - | 96800 | -3.2 % |

| 07-02-1996 | 9.49 | - | 94900 | -5.1 % |

| 07-03-1996 | 9.91 | - | 99100 | -0.9 % |

| 02-04-1996 | 10.09 | - | 100900 | 0.9 % |

| 07-05-1996 | 10.48 | - | 104800 | 4.8 % |

| 07-06-1996 | 10.76 | - | 107600 | 7.6 % |

| 01-07-1996 | 10.68 | - | 106800 | 6.8 % |

| 07-08-1996 | 10.65 | - | 106500 | 6.5 % |

| 02-09-1996 | 10.6 | - | 106000 | 6.0 % |

| 07-10-1996 | 9.53 | - | 95300 | -4.7 % |

| 07-11-1996 | 9.71 | - | 97100 | -2.9 % |

| 02-12-1996 | 9.34 | - | 93400 | -6.6 % |

| 07-01-1997 | 9.62 | - | 96200 | -3.8 % |

| 07-02-1997 | 9.79 | - | 97900 | -2.1 % |

| 01-03-1997 | 10.01 | - | 100100 | 0.1 % |

| 07-04-1997 | 10.09 | - | 100900 | 0.9 % |

| 02-05-1997 | 10.24 | - | 102400 | 2.4 % |

| 02-06-1997 | 10.32 | - | 103200 | 3.2 % |

| 01-07-1997 | 10.7 | - | 107000 | 7.0 % |

| 01-08-1997 | 10.83 | - | 108300 | 8.3 % |

| 01-09-1997 | 10.76 | - | 107600 | 7.6 % |

| 01-10-1997 | 10.85 | - | 108500 | 8.5 % |

| 03-11-1997 | 10.91 | - | 109100 | 9.1 % |

| 01-12-1997 | 10.92 | - | 109200 | 9.2 % |

| 05-01-1998 | 11.29 | - | 112900 | 12.9 % |

| 02-02-1998 | 10.95 | - | 109500 | 9.5 % |

| 02-03-1998 | 11.36 | - | 113600 | 13.6 % |

| 02-04-1998 | 11.7 | - | 117000 | 17.0 % |

| 04-05-1998 | 12.07 | - | 120700 | 20.7 % |

| 01-06-1998 | 11.44 | - | 114400 | 14.4 % |

| 01-07-1998 | 11.1 | - | 111000 | 11.0 % |

| 03-08-1998 | 11.14 | - | 111400 | 11.4 % |

| 01-09-1998 | 10.95 | - | 109500 | 9.5 % |

| 05-10-1998 | 11.01 | - | 110100 | 10.1 % |

| 02-11-1998 | 11.03 | - | 110300 | 10.3 % |

| 01-12-1998 | 10.82 | - | 108200 | 8.2 % |

| 01-01-1999 | 11.38 | - | 113800 | 13.8 % |

| 01-02-1999 | 12.18 | - | 121800 | 21.8 % |

| 01-03-1999 | 13.24 | - | 132400 | 32.4 % |

| 05-04-1999 | 13.17 | - | 131700 | 31.7 % |

| 03-05-1999 | 12.08 | - | 120800 | 20.8 % |

| 01-06-1999 | 13.06 | - | 130600 | 30.6 % |

| 01-07-1999 | 13.21 | - | 132100 | 32.1 % |

| 02-08-1999 | 13.98 | - | 139800 | 39.8 % |

| 01-09-1999 | 14.35 | - | 143500 | 43.5 % |

| 01-10-1999 | 15.07 | - | 150700 | 50.7 % |

| 01-11-1999 | 14.13 | - | 141300 | 41.3 % |

| 01-12-1999 | 15.81 | - | 158100 | 58.1 % |

| 03-01-2000 | 19.93 | - | 199300 | 99.3 % |

| 01-02-2000 | 20.62 | - | 206200 | 106.2 % |

| 01-03-2000 | 21.74 | - | 217400 | 117.4 % |

| 03-04-2000 | 18.92 | - | 189200 | 89.2 % |

| 02-05-2000 | 16.62 | - | 166200 | 66.2 % |

| 01-06-2000 | 16.01 | - | 160100 | 60.1 % |

| 03-07-2000 | 17.51 | - | 175100 | 75.1 % |

| 01-08-2000 | 15.99 | - | 159900 | 59.9 % |

| 04-09-2000 | 17.09 | - | 170900 | 70.9 % |

| 03-10-2000 | 15.68 | - | 156800 | 56.8 % |

| 01-11-2000 | 15.61 | - | 156100 | 56.1 % |

| 01-12-2000 | 15.93 | - | 159300 | 59.3 % |

| 01-01-2001 | 15.17 | - | 151700 | 51.7 % |

| 01-02-2001 | 15.07 | - | 150700 | 50.7 % |

| 01-03-2001 | 10.47 | - | 104700 | 4.7 % |

| 02-04-2001 | 10.18 | - | 101800 | 1.8 % |

| 02-05-2001 | 12.26 | - | 122600 | 22.6 % |

| 01-06-2001 | 13.72 | - | 137200 | 37.2 % |

| 01-07-2001 | 13.92 | - | 139200 | 39.2 % |

| 01-08-2001 | 14.42 | - | 144200 | 44.2 % |

| 02-09-2001 | 15.16 | - | 151600 | 51.6 % |

| 01-10-2001 | 13.76 | - | 137600 | 37.6 % |

| 01-11-2001 | 14.36 | - | 143600 | 43.6 % |

| 03-12-2001 | 15.07 | - | 150700 | 50.7 % |

| 01-01-2002 | 14.82 | - | 148200 | 48.2 % |

| 01-02-2002 | 15.17 | - | 151700 | 51.7 % |

| 01-03-2002 | 16.14 | - | 161400 | 61.4 % |

| 01-04-2002 | 16.15 | - | 161500 | 61.5 % |

| 02-05-2002 | 16.19 | - | 161900 | 61.9 % |

| 03-06-2002 | 16.14 | - | 161400 | 61.4 % |

| 01-07-2002 | 16.46 | - | 164600 | 64.6 % |

| 01-08-2002 | 16.06 | - | 160600 | 60.6 % |

| 02-09-2002 | 16.37 | - | 163700 | 63.7 % |

| 01-10-2002 | 15.54 | - | 155400 | 55.4 % |

| 01-11-2002 | 15.53 | - | 155300 | 55.3 % |

| 02-12-2002 | 16.16 | - | 161600 | 61.6 % |

| 01-01-2003 | 16.62 | - | 166200 | 66.2 % |

| 03-02-2003 | 16.4 | - | 164000 | 64.0 % |

| 03-03-2003 | 16.41 | - | 164100 | 64.1 % |

| 01-04-2003 | 15.84 | - | 158400 | 58.4 % |

| 02-05-2003 | 15.98 | - | 159800 | 59.8 % |

| 02-06-2003 | 17.09 | - | 170900 | 70.9 % |

| 01-07-2003 | 18.03 | - | 180300 | 80.3 % |

| 01-08-2003 | 19.13 | - | 191300 | 91.3 % |

| 01-09-2003 | 20.23 | - | 202300 | 102.3 % |

| 01-10-2003 | 13.36 | - | 133600 | 33.6 % |

| 01-11-2003 | 14.18 | - | 141800 | 41.8 % |

| 01-12-2003 | 14.73 | - | 147300 | 47.3 % |

| 01-01-2004 | 11.65 | - | 116500 | 16.5 % |

| 03-02-2004 | 11.04 | - | 110400 | 10.4 % |

| 01-03-2004 | 11.53 | - | 115300 | 15.3 % |

| 01-04-2004 | 11.58 | - | 115800 | 15.8 % |

| 03-05-2004 | 11.38 | - | 113800 | 13.8 % |

| 01-06-2004 | 10.34 | - | 103400 | 3.4 % |

| 01-07-2004 | 10.46 | - | 104600 | 4.6 % |

| 02-08-2004 | 10.85 | - | 108500 | 8.5 % |

| 01-09-2004 | 11.05 | - | 110500 | 10.5 % |

| 01-10-2004 | 11.55 | - | 115500 | 15.5 % |

| 01-11-2004 | 11.63 | - | 116300 | 16.3 % |

| 01-12-2004 | 12.17 | - | 121700 | 21.7 % |

| 03-01-2005 | 13.01 | - | 130100 | 30.1 % |

| 01-02-2005 | 12.75 | - | 127500 | 27.5 % |

| 01-03-2005 | 13.07 | - | 130700 | 30.7 % |

| 01-04-2005 | 13.07 | - | 130700 | 30.7 % |

| 02-05-2005 | 12.71 | - | 127100 | 27.1 % |

| 01-06-2005 | 13.21 | - | 132100 | 32.1 % |

| 01-07-2005 | 13.5 | - | 135000 | 35.0 % |

| 01-08-2005 | 14.05 | - | 140500 | 40.5 % |

| 01-09-2005 | 14.99 | - | 149900 | 49.9 % |

| 03-10-2005 | 15.65 | - | 156500 | 56.5 % |

| 02-11-2005 | 14.64 | - | 146400 | 46.4 % |

| 01-12-2005 | 16.03 | - | 160300 | 60.3 % |

| 02-01-2006 | 16.6 | - | 166000 | 66.0 % |

| 01-02-2006 | 17.57 | - | 175700 | 75.7 % |

| 01-03-2006 | 18.88 | - | 188800 | 88.8 % |

| 03-04-2006 | 20.48 | - | 204800 | 104.8 % |

| 02-05-2006 | 22.09 | - | 220900 | 120.9 % |

| 01-06-2006 | 18.87 | - | 188700 | 88.7 % |

| 03-07-2006 | 18.91 | - | 189100 | 89.1 % |

| 01-08-2006 | 18.83 | - | 188300 | 88.3 % |

| 01-09-2006 | 20.02 | - | 200200 | 100.2 % |

| 03-10-2006 | 21.06 | - | 210600 | 110.6 % |

| 01-11-2006 | 21.84 | - | 218400 | 118.4 % |

| 01-12-2006 | 23.49 | - | 234900 | 134.9 % |

| 02-01-2007 | 23.56 | - | 235600 | 135.6 % |

| 01-02-2007 | 23.87 | - | 238700 | 138.7 % |

| 01-03-2007 | 22.07 | - | 220700 | 120.7 % |

| 02-04-2007 | 21.46 | - | 214600 | 114.6 % |

| 03-05-2007 | 23.87 | - | 238700 | 138.7 % |

| 01-06-2007 | 24.7351 | - | 247351 | 147.35 % |

| 02-07-2007 | 25.2809 | - | 252809 | 152.81 % |

| 01-08-2007 | 26.3687 | - | 263687 | 163.69 % |

| 03-09-2007 | 28.1385 | - | 281385 | 181.38 % |

| 01-10-2007 | 30.6378 | - | 306378 | 206.38 % |

| 01-11-2007 | 31.2183 | - | 312183 | 212.18 % |

| 03-12-2007 | 32.0838 | - | 320838 | 220.84 % |

| 01-01-2008 | 34.3443 | - | 343443 | 243.44 % |

| 01-02-2008 | 28.7491 | - | 287491 | 187.49 % |

| 03-03-2008 | 26.9213 | - | 269213 | 169.21 % |

| 01-04-2008 | 24.1767 | - | 241767 | 141.77 % |

| 02-05-2008 | 26.4786 | - | 264786 | 164.79 % |

| 02-06-2008 | 23.5945 | - | 235945 | 135.94 % |

| 01-07-2008 | 19.9536 | - | 199536 | 99.54 % |

| 01-08-2008 | 21.5009 | - | 215009 | 115.01 % |

| 01-09-2008 | 21.6399 | - | 216399 | 116.4 % |

| 01-10-2008 | 18.5249 | - | 185249 | 85.25 % |

| 03-11-2008 | 14.2286 | - | 142286 | 42.29 % |

| 01-12-2008 | 13.0936 | - | 130936 | 30.94 % |

| 01-01-2009 | 15.0126 | - | 150126 | 50.13 % |

| 02-02-2009 | 13.0573 | - | 130573 | 30.57 % |

| 02-03-2009 | 12.5702 | - | 125702 | 25.7 % |

| 01-04-2009 | 13.7264 | - | 137264 | 37.26 % |

| 04-05-2009 | 16.4781 | - | 164781 | 64.78 % |

| 01-06-2009 | 20.4977 | - | 204977 | 104.98 % |

| 01-07-2009 | 19.8751 | - | 198751 | 98.75 % |

| 03-08-2009 | 20.8266 | - | 208266 | 108.27 % |

| 01-09-2009 | 20.5863 | - | 205863 | 105.86 % |

| 01-10-2009 | 21.8924 | - | 218924 | 118.92 % |

| 03-11-2009 | 19.7619 | - | 197619 | 97.62 % |

| 01-12-2009 | 21.4111 | - | 214111 | 114.11 % |

| 04-01-2010 | 21.8008 | - | 218008 | 118.01 % |

| 01-02-2010 | 20.6972 | - | 206972 | 106.97 % |

| 02-03-2010 | 20.6152 | - | 206152 | 106.15 % |

| 01-04-2010 | 21.5028 | - | 215028 | 115.03 % |

| 03-05-2010 | 22.4066 | - | 224066 | 124.07 % |

| 01-06-2010 | 21.6086 | - | 216086 | 116.09 % |

| 01-07-2010 | 23.0079 | - | 230079 | 130.08 % |

| 02-08-2010 | 23.9486 | - | 239486 | 139.49 % |

| 01-09-2010 | 23.3776 | - | 233776 | 133.78 % |

| 01-10-2010 | 25.0424 | - | 250424 | 150.42 % |

| 01-11-2010 | 24.9785 | - | 249785 | 149.78 % |

| 01-12-2010 | 23.8545 | - | 238545 | 138.55 % |

| 03-01-2011 | 24.3115 | - | 243115 | 143.11 % |

| 01-02-2011 | 21.8041 | - | 218041 | 118.04 % |

| 01-03-2011 | 21.8681 | - | 218681 | 118.68 % |

| 01-04-2011 | 23.0036 | - | 230036 | 130.04 % |

| 02-05-2011 | 22.5442 | - | 225442 | 125.44 % |

| 01-06-2011 | 22.2688 | - | 222688 | 122.69 % |

| 01-07-2011 | 22.5633 | - | 225633 | 125.63 % |

| 01-08-2011 | 22.1684 | - | 221684 | 121.68 % |

| 02-09-2011 | 21.1561 | - | 211561 | 111.56 % |

| 03-10-2011 | 20.5953 | - | 205953 | 105.95 % |

| 01-11-2011 | 21.6938 | - | 216938 | 116.94 % |

| 01-12-2011 | 20.9805 | - | 209805 | 109.8 % |

| 02-01-2012 | 19.9955 | - | 199955 | 99.95 % |

| 01-02-2012 | 21.5827 | - | 215827 | 115.83 % |

| 01-03-2012 | 22.0204 | - | 220204 | 120.2 % |

| 02-04-2012 | 22.191 | - | 221910 | 121.91 % |

| 02-05-2012 | 21.6416 | - | 216416 | 116.42 % |

| 01-06-2012 | 20.613 | - | 206130 | 106.13 % |

| 02-07-2012 | 21.7811 | - | 217811 | 117.81 % |

| 01-08-2012 | 21.6962 | - | 216962 | 116.96 % |

| 03-09-2012 | 21.6832 | - | 216832 | 116.83 % |

| 01-10-2012 | 23.3826 | - | 233826 | 133.83 % |

| 01-11-2012 | 23.402 | - | 234020 | 134.02 % |

| 03-12-2012 | 24.4948 | - | 244948 | 144.95 % |

| 01-01-2013 | 25.0025 | - | 250025 | 150.03 % |

| 01-02-2013 | 24.5371 | - | 245371 | 145.37 % |

| 01-03-2013 | 23.1592 | - | 231592 | 131.59 % |

| 01-04-2013 | 22.9084 | - | 229084 | 129.08 % |

| 02-05-2013 | 25.0031 | - | 250031 | 150.03 % |

| 03-06-2013 | 25.0636 | - | 250636 | 150.64 % |

| 01-07-2013 | 25.1479 | - | 251479 | 151.48 % |

| 01-08-2013 | 23.9861 | - | 239861 | 139.86 % |

| 02-09-2013 | 22.8902 | - | 228902 | 128.9 % |

| 01-10-2013 | 25.1834 | - | 251834 | 151.83 % |

| 01-11-2013 | 26.9889 | - | 269889 | 169.89 % |

| 02-12-2013 | 27.3039 | - | 273039 | 173.04 % |

| 01-01-2014 | 27.6279 | - | 276279 | 176.28 % |

| 03-02-2014 | 25.9808 | - | 259808 | 159.81 % |

| 03-03-2014 | 27.0606 | - | 270606 | 170.61 % |

| 01-04-2014 | 28.9391 | - | 289391 | 189.39 % |

| 02-05-2014 | 29.2462 | - | 292462 | 192.46 % |

| 02-06-2014 | 33.0058 | - | 330058 | 230.06 % |

| 01-07-2014 | 35.0361 | - | 350361 | 250.36 % |

| 01-08-2014 | 34.5279 | - | 345279 | 245.28 % |

| 01-09-2014 | 36.4942 | - | 364942 | 264.94 % |

| 01-10-2014 | 36.604 | - | 366040 | 266.04 % |

| 03-11-2014 | 36.9167 | - | 369167 | 269.17 % |

| 01-12-2014 | 37.7577 | - | 377577 | 277.58 % |

| 01-01-2015 | 36.8679 | - | 368679 | 268.68 % |

| 02-02-2015 | 38.5428 | - | 385428 | 285.43 % |

| 02-03-2015 | 39.0445 | - | 390445 | 290.44 % |

| 01-04-2015 | 38.6697 | - | 386697 | 286.7 % |

| 04-05-2015 | 37.6244 | - | 376244 | 276.24 % |

| 01-06-2015 | 38.1088 | - | 381088 | 281.09 % |

| 01-07-2015 | 38.248 | - | 382480 | 282.48 % |

| 03-08-2015 | 38.7314 | - | 387314 | 287.31 % |

| 01-09-2015 | 36.2585 | - | 362585 | 262.58 % |

| 01-10-2015 | 36.9058 | - | 369058 | 269.06 % |

| 02-11-2015 | 37.2245 | - | 372245 | 272.25 % |

| 01-12-2015 | 36.8721 | - | 368721 | 268.72 % |

| 01-01-2016 | 36.8701 | - | 368701 | 268.7 % |

| 01-02-2016 | 35.6444 | - | 356444 | 256.44 % |

| 01-03-2016 | 34.4287 | - | 344287 | 244.29 % |

| 01-04-2016 | 36.0902 | - | 360902 | 260.9 % |

| 02-05-2016 | 36.3277 | - | 363277 | 263.28 % |

| 01-06-2016 | 37.7479 | - | 377479 | 277.48 % |

| 01-07-2016 | 38.313 | - | 383130 | 283.13 % |

| 01-08-2016 | 39.2657 | - | 392657 | 292.66 % |

| 01-09-2016 | 39.7092 | - | 397092 | 297.09 % |

| 03-10-2016 | 39.5616 | - | 395616 | 295.62 % |

| 01-11-2016 | 39.2495 | - | 392495 | 292.5 % |

| 01-12-2016 | 37.8857 | - | 378857 | 278.86 % |

| 02-01-2017 | 37.9203 | - | 379203 | 279.2 % |

| 01-02-2017 | 39.7054 | - | 397054 | 297.05 % |

| 01-03-2017 | 40.4662 | - | 404662 | 304.66 % |

| 03-04-2017 | 41.3687 | - | 413687 | 313.69 % |

| 02-05-2017 | 41.5674 | - | 415674 | 315.67 % |

| 01-06-2017 | 42.5645 | - | 425645 | 325.64 % |

| 03-07-2017 | 42.6511 | - | 426511 | 326.51 % |

| 01-08-2017 | 44.2342 | - | 442342 | 342.34 % |

| 01-09-2017 | 43.8421 | - | 438421 | 338.42 % |

| 03-10-2017 | 43.4436 | - | 434436 | 334.44 % |

| 01-11-2017 | 44.9893 | - | 449893 | 349.89 % |

| 01-12-2017 | 43.7752 | - | 437752 | 337.75 % |

| 01-01-2018 | 44.6622 | - | 446622 | 346.62 % |

| 01-02-2018 | 46.3921 | - | 463921 | 363.92 % |

| 01-03-2018 | 44.79 | - | 447900 | 347.9 % |

| 02-04-2018 | 43.999 | - | 439990 | 339.99 % |

| 02-05-2018 | 44.8436 | - | 448436 | 348.44 % |

| 01-06-2018 | 44.9311 | - | 449311 | 349.31 % |

| 02-07-2018 | 44.937 | - | 449370 | 349.37 % |

| 01-08-2018 | 46.0378 | - | 460378 | 360.38 % |

| 03-09-2018 | 46.4497 | - | 464497 | 364.5 % |

| 01-10-2018 | 45.6708 | - | 456708 | 356.71 % |

| 01-11-2018 | 44.8373 | - | 448373 | 348.37 % |

| 03-12-2018 | 45.6562 | - | 456562 | 356.56 % |

| 01-01-2019 | 45.7627 | - | 457627 | 357.63 % |

| 01-02-2019 | 45.739 | - | 457390 | 357.39 % |

| 01-03-2019 | 45.692 | - | 456920 | 356.92 % |

| 01-04-2019 | 47.1346 | - | 471346 | 371.35 % |

| 02-05-2019 | 46.606 | - | 466060 | 366.06 % |

| 03-06-2019 | 47.6486 | - | 476486 | 376.49 % |

| 01-07-2019 | 42.5266 | - | 425266 | 325.27 % |

| 01-08-2019 | 39.0777 | - | 390777 | 290.78 % |

| 03-09-2019 | 38.9715 | - | 389715 | 289.71 % |

| 01-10-2019 | 39.69 | - | 396900 | 296.9 % |

| 01-11-2019 | 40.327 | - | 403270 | 303.27 % |

| 02-12-2019 | 41.6012 | - | 416012 | 316.01 % |

| 01-01-2020 | 41.9152 | - | 419152 | 319.15 % |

| 03-02-2020 | 41.1143 | - | 411143 | 311.14 % |

| 02-03-2020 | 40.2275 | - | 402275 | 302.27 % |

| 01-04-2020 | 32.0988 | - | 320988 | 220.99 % |

| 04-05-2020 | 34.1978 | - | 341978 | 241.98 % |

| 01-06-2020 | 35.5228 | - | 355228 | 255.23 % |

| 01-07-2020 | 37.0923 | - | 370923 | 270.92 % |

| 03-08-2020 | 44.2593 | - | 442593 | 342.59 % |

| 01-09-2020 | 46.2496 | - | 462496 | 362.5 % |

| 01-10-2020 | 46.0373 | - | 460373 | 360.37 % |

| 02-11-2020 | 46.7783 | - | 467783 | 367.78 % |

| 01-12-2020 | 52.5939 | - | 525939 | 425.94 % |

| 01-01-2021 | 55.0693 | - | 550693 | 450.69 % |

| 01-02-2021 | 55.4911 | - | 554911 | 454.91 % |

| 01-03-2021 | 58.6812 | - | 586812 | 486.81 % |

| 01-04-2021 | 59.1885 | - | 591885 | 491.88 % |

| 03-05-2021 | 59.8651 | - | 598651 | 498.65 % |

| 01-06-2021 | 61.875 | - | 618750 | 518.75 % |

| 01-07-2021 | 62.9936 | - | 629936 | 529.94 % |

| 02-08-2021 | 65.2237 | - | 652237 | 552.24 % |

| 01-09-2021 | 67.8347 | - | 678347 | 578.35 % |

| 01-10-2021 | 69.8684 | - | 698684 | 598.68 % |

| 01-11-2021 | 70.4123 | - | 704123 | 604.12 % |

| 01-12-2021 | 66.9686 | - | 669686 | 569.69 % |

| 03-01-2022 | 68.1695 | - | 681695 | 581.7 % |

| 01-02-2022 | 68.2706 | - | 682706 | 582.71 % |

| 02-03-2022 | 64.5744 | - | 645744 | 545.74 % |

| 01-04-2022 | 67.8424 | - | 678424 | 578.42 % |

| 02-05-2022 | 65.6494 | - | 656494 | 556.49 % |

| 01-06-2022 | 64.0098 | - | 640098 | 540.1 % |

| 01-07-2022 | 63.018 | - | 630180 | 530.18 % |

| 01-08-2022 | 67.6719 | - | 676719 | 576.72 % |

| 01-09-2022 | 69.0215 | - | 690215 | 590.22 % |

| 03-10-2022 | 67.2688 | - | 672688 | 572.69 % |

| 01-11-2022 | 71.2144 | - | 712144 | 612.14 % |

| 01-12-2022 | 73.987 | - | 739870 | 639.87 % |

| 02-01-2023 | 73.4659 | - | 734659 | 634.66 % |

| 01-02-2023 | 71.3601 | - | 713601 | 613.6 % |

| 01-03-2023 | 72.2192 | - | 722192 | 622.19 % |

| 03-04-2023 | 71.2845 | - | 712845 | 612.85 % |

| 02-05-2023 | 73.0585 | - | 730585 | 630.59 % |

| 01-06-2023 | 75.6444 | - | 756444 | 656.44 % |

| 03-07-2023 | 79.3189 | - | 793189 | 693.19 % |

| 01-08-2023 | 83.5473 | - | 835473 | 735.47 % |

| 01-09-2023 | 86.6444 | - | 866444 | 766.44 % |

| 03-10-2023 | 87.8633 | - | 878633 | 778.63 % |

| 01-11-2023 | 86.4449 | - | 864449 | 764.45 % |

| 01-12-2023 | 93.5146 | - | 935146 | 835.15 % |

| 01-01-2024 | 98.0032 | - | 980032 | 880.03 % |

| 01-02-2024 | 103.9345 | - | 1039345 | 939.34 % |

| 01-03-2024 | 107.8577 | - | 1078577 | 978.58 % |

| 01-04-2024 | 107.2157 | - | 1072157 | 972.16 % |

| 02-05-2024 | 114.0853 | - | 1140853 | 1040.85 % |

| 03-06-2024 | 117.8233 | - | 1178233 | 1078.23 % |

| 01-07-2024 | 124.2379 | - | 1242379 | 1142.38 % |

| 01-08-2024 | 126.6226 | - | 1266226 | 1166.23 % |

| 02-09-2024 | 128.9563 | - | 1289563 | 1189.56 % |

| 01-10-2024 | 129.253 | - | 1292530 | 1192.53 % |

| 04-11-2024 | 123.893 | - | 1238930 | 1138.93 % |

| 02-12-2024 | 125.0975 | - | 1250975 | 1150.98 % |

| 01-01-2025 | 124.2604 | - | 1242604 | 1142.6 % |

| 03-02-2025 | 115.9698 | - | 1159698 | 1059.7 % |

| 03-03-2025 | 108.9284 | - | 1089284 | 989.28 % |

| 01-04-2025 | 112.0222 | - | 1120222 | 1020.22 % |

| 02-05-2025 | 115.103 | - | 1151030 | 1051.03 % |

| 02-06-2025 | 117.7765 | - | 1177765 | 1077.76 % |

| 01-07-2025 | 122.9991 | - | 1229991 | 1129.99 % |

| 01-08-2025 | 119.2379 | - | 1192379 | 1092.38 % |

| 01-09-2025 | 118.956 | - | 1189560 | 1089.56 % |

| 01-10-2025 | 119.5694 | - | 1195694 | 1095.69 % |

| 03-11-2025 | 123.2344 | - | 1232344 | 1132.34 % |

| 01-12-2025 | 122.0322 | - | 1220322 | 1120.32 % |

| 01-01-2026 | 119.6348 | - | 1196348 | 1096.35 % |

| 16-01-2026 | 118.9691 | - | 1189691 | 1089.69 % |

RETURNS CALCULATOR for JM Aggressive Hybrid Fund (Regular) -Growth Option

Growth of 10000 In SIP (Fund vs Benchmark)

Growth of 10000 In LUMPSUM (Fund vs Benchmark)

Rolling Returns

Rolling returns are the annualized returns of the scheme taken for a specified period (rolling returns period) on every day/week/month and taken till the last day of the duration. In this chart we are showing the annualized returns over the rolling returns period on every day from the start date and comparing it with the benchmark. Rolling returns is the best measure of a fund's performance. Trailing returns have a recency bias and point to point returns are specific to the period in consideration. Rolling returns, on the other hand, measures the fund's absolute and relative performance across all timescales, without bias.

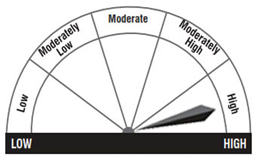

Riskometer

Key Performance and Risk Statistics of JM Aggressive Hybrid Fund (Regular) -Growth Option

| Key Statistics | Volatility | Sharpe Ratio | Alpha | Beta | Yield to Maturity | Average Maturity |

|---|---|---|---|---|---|---|

| JM Aggressive Hybrid Fund (Regular) -Growth Option | 10.95 | 0.97 | 5.31 | 1.05 | 7.04 | 5.12 |

| Hybrid: Aggressive | - | - | - | - | - | - |

PEER COMPARISION of JM Aggressive Hybrid Fund (Regular) -Growth Option

PORTFOLIO ANALYSIS of JM Aggressive Hybrid Fund (Regular) -Growth Option

Asset Allocation (%)

| Allocation | Percentage (%) |

|---|

Market Cap Distribution

Small Cap

18.35%

Others

22.63%

Large Cap

42.28%

Mid Cap

16.7%

Total

100%